Financial Literacy: A Real & Relevant Way to Meet Math Standards & Develop #MoneySmartKids

Tools and ideas to transform education. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Like many adults of my generation, I left high school and college without financial literacy skills. I’m not alone. In fact two-thirds of Americans couldn’t even pass a basic financial literacy test. It’s no wonder our household debt in our country is at a new peak.

Despite being one of the most important topics to prepare students for success in the world, financial literacy is not present in most classrooms. It also is not included in many pre-service teaching programs.

Fortunately, it seems more and more institutions are taking notice and stepping up to provide resources that educators can incorporate into the classroom at no cost.

Financial Literacy Interactive for Students

Star Banks Adventure Game is one that provides an interactive way to help students grasp important real-world financial concepts. Student learn about 1) setting financial goals, 2) saving and spending wisely, 3) asset allocation, 4) earning interest, 5) inflation and even 6) diversification. It can be played on the web via a computer, laptop, or Chromebooks as well as on iOS and Android devices.

Financial Literacy Quiz for Adults

Students aren’t the only ones who will benefit. Teachers and families can learn right along with students. On the resource page educators can start by taking a money smarts quiz and instantly get their results. Did you know saving just $166 a month after college in an investment with a 7% compounded rate of return, would earn you have half a million dollars upon retirement? If you did, you may score well on the quiz.

Financial Literacy Site for Families

There is a whole site for families where they can access the quiz, find conversation starters, and find a 30 day calendar to financial literacy. The calendar provides activities that can be done and reinforced in the classroom or home. For example, one activity is visiting a bank. Something that could be a fun class field trip as well as an enlightening experience to do with a parent. Resources such as this are an important support for families. That’s because despite the fact that 69% of parents want to set a good financial example for their children, most find talking to their children worrisome so are reluctant to do so.

Support and Resources for Educators

Teachers have access to a helpful curriculum matrix that correlates to the national standards that put a smile on many administrator’s faces. The Teacher version has a Classroom Mode that ties to the six key literacy concepts that align to standards in personal finance, economics and the Common Core. Teachers can break down the six concepts in the game and integrate them into existing lessons along with a host of educator resources they will find at Money Confident Kids.com. There they’ll find teaching tools and activities such as downloadable magazines for students, printables, videos, conversation starters and more.

Tools and ideas to transform education. Sign up below.

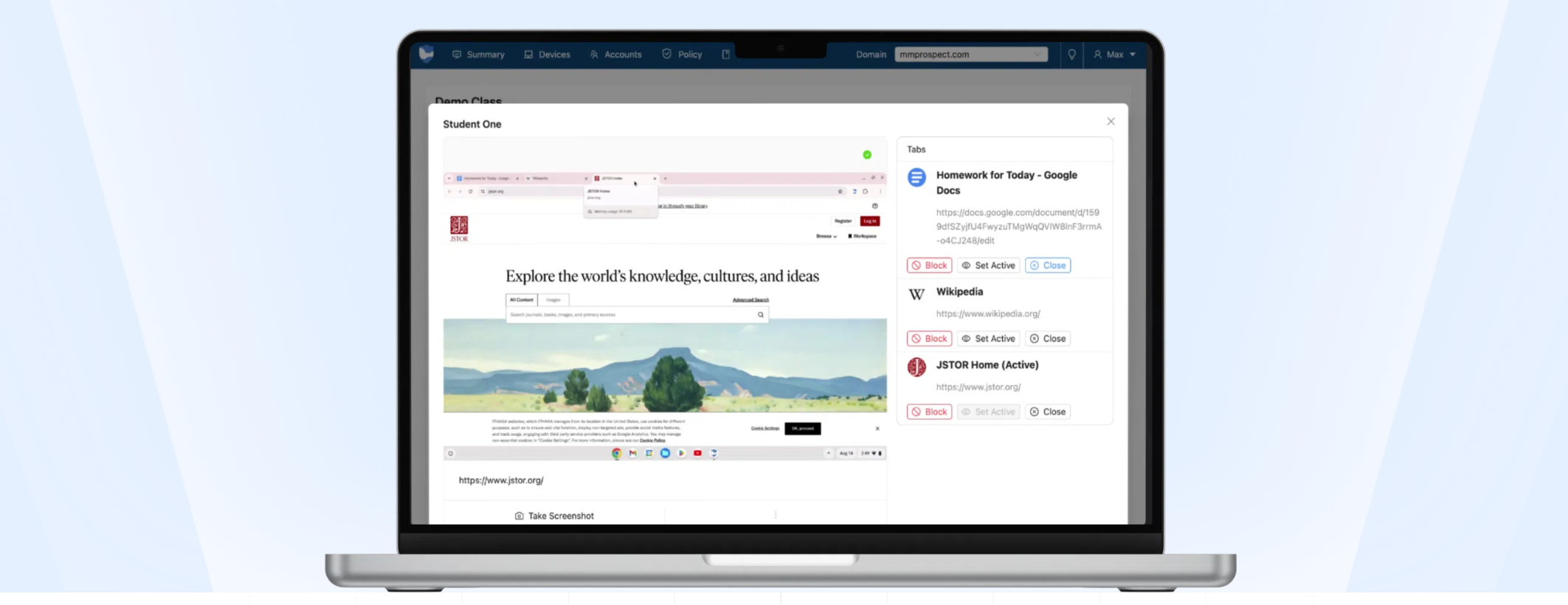

Educators can look under the hood at what their students are doing with a Teacher Dashboard. The Dashboard website helps teachers administer the game in the classroom and provides statistics that help compare different classrooms and track individual students' progress. Students will know their progress because they collect Trophies (for completing levels) and Graduation Hats (by completing Quizzes).

Innovative educators know the importance of teaching digital literacy, computer literacy, media literacy, and news literacy. The Star Banks Adventure Game provides educators with an interactive game, accompanying materials, and resources for parents that will help ensure students are prepared for success with financial literacy as well.

Lisa Nielsen writes for and speaks to audiences across the globe about learning innovatively and is frequently covered by local and national media for her views on “Passion (not data) Driven Learning,” "Thinking Outside the Ban" to harness the power of technology for learning, and using the power of social media to provide a voice to educators and students. Ms. Nielsen has worked for more than a decade in various capacities to support learning in real and innovative ways that will prepare students for success. In addition to her award-winning blog, The Innovative Educator, Ms. Nielsen’s writing is featured in places such as Huffington Post, Tech & Learning, ISTE Connects, ASCD Wholechild, MindShift, Leading & Learning, The Unplugged Mom, and is the author the book Teaching Generation Text.

Disclaimer: The information shared here is strictly that of the author and does not reflect the opinions or endorsement of her employer.

Lisa Nielsen (@InnovativeEdu) has worked as a public-school educator and administrator since 1997. She is a prolific writer best known for her award-winning blog, The Innovative Educator. Nielsen is the author of several books and her writing has been featured in media outlets such as The New York Times, The Wall Street Journal, and Tech & Learning.

Disclaimer: The information shared here is strictly that of the author and does not reflect the opinions or endorsement of her employer.